How much can i borrow quick calculator

Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on.

Loan Calculators Emi Calculator Eligibilty Calculator Affordability Calculator Calculate Equated Monthly Installment Emi Loan Calculator Home Loans Loan

Flexible fixed rate loans can even come with 100 offset accounts.

. How do you determine a diamonds value. We can give an idea of how much of a mortgage you could get with us if you let us know about your earning and spending. How much can I borrow.

You can calculate your repayments for a loan between 2000 and 65000. This will boost the amount you. 31000 23000 subsidized 7000 unsubsidized Independent.

Whether youre looking to take a 5000 loan or even 15000 our loans calculator can help you work out how much you can afford to borrow by entering how much you can afford to pay back each month and the length of time you can afford to pay that amount and at what interest rate. It will not impact your credit score and takes less than 10 minutes. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

A diamonds value is determined by rarity and market demand. Buy to Let calculator. How much could your customer borrow.

Affordability calculator get a more accurate estimate of how much you could borrow from us. Color cut clarity and carat weightThere are many other factors that play into how much you can expect to receive when selling or using your diamond as collateral for an asset-based loan which we will. Student loans are not limitless.

Lenders are interested in letting you borrow their money because they make money on what. An AIP is a personalised indication of how much you could borrow. Find out how much you can borrow using our mortgage borrowing calculator simply by answering a few questions.

A quick way to borrow money is by applying for an online loan. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home.

Green Home Improvement Loan has a Variable rate from 650 APR. There are enough exceptions to say that credit policies can differ greatly from one bank to another. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you.

2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. How much house can I afford. Many factors go into a diamonds rarity but the most important is the 4 Cs.

Pay down your debt and youll be able to afford a larger mortgage. Maximum borrowing amounts can even differ up to 3x between different banks. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

Your DTI and thus how much you can afford is determined by how much debt you have. If you dont qualify for the best rates try working on your credit score so you arent spending as much on financing costs. Total subsidized and unsubsidized loan limits over the course of your entire education include.

Offset calculator see how much you could save. Life can change incredibly fast and you may need to borrow money quickly for family emergencies car repairs or urgent emergency expenses. Quick answers to all your queries regarding Fixed Rate Home Loans.

Home Loan repayments calculator. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. How much can I borrow calculator.

On to the next. In this example the lender would be willing to offer a loan amount of 171000. Plug in your numbers to get started.

You can also use a loan calculator to see how different rates terms or payments would affect the total cost of your loan. These factors are taken into consideration when a mortgage lender calculates how much they could ideally lend you for a mortgage. We assume homeowners insurance is a percentage of your overall home value.

Use this calculator to figure out how much you could borrow. You get quick wins sooner. Crush the first debt fast.

Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Use our calculator and get started. Fast loans can provide quick cash for short-term borrowing needs 24 7 often in an hour or less.

The amount you can borrow for your mortgage depends on a number of factors these include. Myth 3 Banks only lend up to 70 of your DSR. Your salary bill payments any additional outgoing payments including examples such as student loans or credit card bills.

Variable rates from 68 to 85 APR. Myth 2 The maximum loan amount you can get from each bank doesnt vary much. They typically request at least 5 deposit based on the value of the property.

Yep we can predict the future Our debt calculator can show you just how fast you can get there. Work on your credit. Flexible Fixed Rate Loan.

We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home. Our calculator helps you to understand the benefits of our Buy to Let proposition and shows the options available to your customer to help them get the loan size they want and to maximise their investment opportunity. It is provided as a self-help tool for your independent use.

Did you know there are fixed rate loans that allow extra repayments. Buy now or save more calculator. Lenders generally prefer borrowers that offer a significant deposit.

How Much Can You Afford to Borrow. Pay down debt. Theres no such thing as free.

We use current mortgage information when calculating your home affordability. The amount you can borrow depends on the type of loan you seek your year in school and the cost of attendance. It takes about five to ten minutes.

The results shown are based on information and assumptions provided by you regarding your goals expectations and financial situation. If a house is valued at 180000 a lender would expect a 9000 deposit. So if youre deciding between a loan with a longer repayment term and a lower rate and a loan with a shorter repayment term and a higher rate you can use a calculator to find out which one offers the better deal.

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Simple Loan Calculator

Welcome To Online Banking Personal Loans Online Online Banking Personal Loans

5 Best Mortgage Calculators How Much House Can You Afford

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

6 Things To Do For Quick Approval Of Personal Loan Personal Loans Person Loan

Pin On Mtg

Home Affordability Calculator For Excel

Ever Growing Online Calculator Collection For Calculating Solutions For Financial Business Health Math And More Online Calculator Decision Making Learning

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

5 Best Mortgage Calculators How Much House Can You Afford

Pin On Car Title Loan

Loans Withdrawals Loan Calculator Loan How To Plan

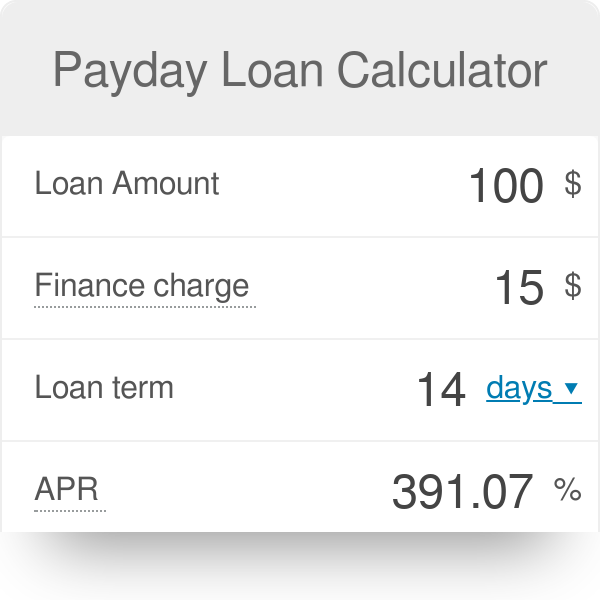

Payday Loan Calculator

Vision Credit Union Calculators

Mortgage Affordability Calculator 2022

Loan Calculator Wolfram Alpha